Dynamics NAV Lot-Tracking Cost Flow Scenario Tested in NAV 2017

- Ken Sebahar

- Oct 4, 2017

- 2 min read

Updated: Aug 4, 2021

Business Issue:

Very often, when a manufacturing company purchases and receives raw materials, these raw material Items are consumed and even sold to the customer before the related Purchase Invoice is received from the Vendor. In this case, what happens if the unit cost on the Invoice is different than the cost that was originally defined on the Purchase Order? Is this difference captured as a general cost adjustment in Microsoft Dynamics NAV, or is the difference applied to the resulting production orders and sales of the finished good Items?

The purpose of this document is to show how expected and actual (“Invoiced”) costs for lot-tracked raw materials flow through the production and sales processes in the case where the Purchase Invoice is posted after the raw material is consumed into a Production Order, and also when the Purchase Invoice is posted after both the consumption of raw material into the Production Order and the sale of the finished good Item to the customer.

Assumptions:

A lot-tracked raw material Item well as a lot-tracked finished good Item are used, otherwise NAV would not have a way to link the raw materials all the way through to the exact finished goods that were delivered on each sales invoice.

Actual costing is used (lot-specific). In a Standard Cost environment, the standard costs are always applied and variances recorded as needed.

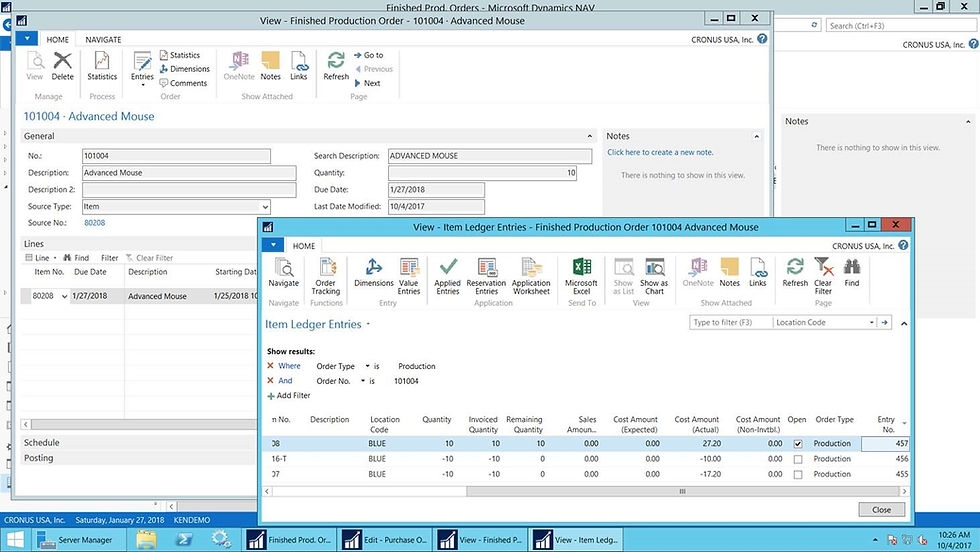

First, 100 PCS of lot-tracked cables (80216-T) are received on a Purchase Order at $1.00/PCS. The quantity is received into inventory at the expected cost based on the Purchase Order amount. Next, a Production Order was created and “Finished” for Item No. 80208 that consumed 10 of the cables at $1.00 each. The screenshot below shows that the expected cost the 80216-T Item at $1.00 each.

Next, the Purchase for Item 80216-T was “Invoiced” at a cost of $1.25 each.

The screenshot below now shows that the Production Order Statistics accurately reflects the adjusted cost of Item No. 80216-T (cables).

When this finished good Item (80208) is later sold to a Customer, it will reflect the invoiced raw material cost of $1.25/PCS within the COGS for the finished good item.

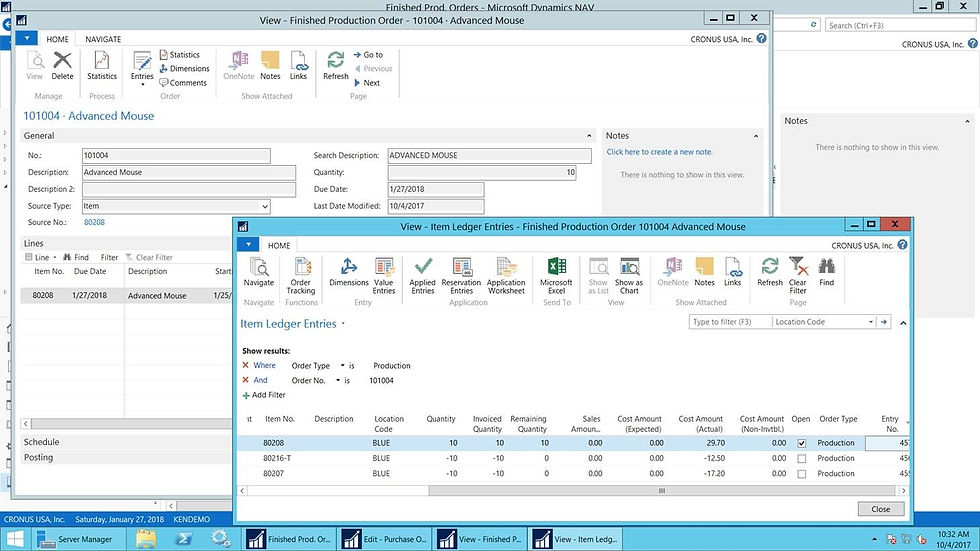

But what if the Production Order was “Finished” AND the Item was sold to a Customer before the Purchase Order was invoiced?

In this scenario, we repeated the steps above and also created, shipped, and invoiced a Sales Order to record the sale of the finished good produced on the Production Order. The screenshot below of the Sales Invoice Statistics shows an “Adjusted Cost” of $22.50, which is the COGS for the finished good Item based on the cost of $1.00 for raw material 80216-T (cables).

Finally, the Purchase Order for Item 80216-T was “Invoiced” at $1.25/PCS. The screenshot below now shows that the “Adjusted Cost” has been increased from $22.50 to $25.00 (10 pieces * $0.25 additional cost based on the invoice of the lot-tracked component that was used). A corresponding entry was also posted to the General Ledger to increase the COGS associated with this sale.

Business Resolution:

When a Purchase Order is “Invoiced” within Dynamics NAV for a lot-tracked raw material, all resulting transactions within NAV are updated to reflect this adjusted cost including the Production Order history, Sales/COGS history, and all of the associated G/L Entries.

Pretty awesome!